The recession alarms have been going off lately– the war in Ukraine, sky-high inflation, rising interest rates, and falling economic growth.

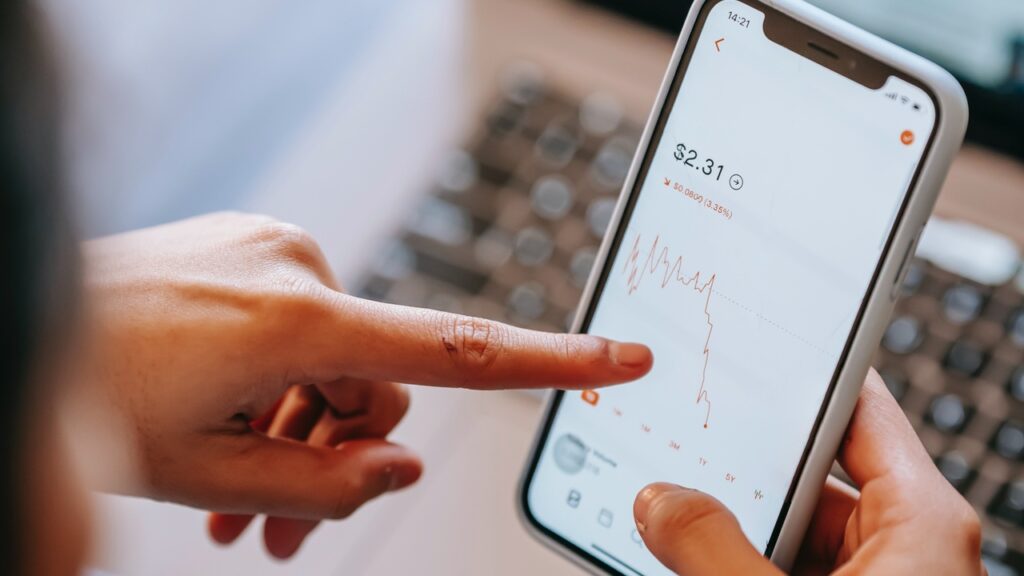

Wild swings during a recession may seem worrisome, but turmoil also seeds opportunity.

The sharp declines in stock prices during a recession may present good opportunities to build an investment portfolio that will stand the test of time and be very profitable once economic growth restarts again.

But it’s not always the case. Financial markets tend to be cyclic with recurring patterns of expansion, peak, recession, trough, and recovery.

While every recession has been followed by a recovery, recovery hasn’t constantly been significant or arrived soon. Some companies may not recover from a recession for years. Others may not recover at all.

What Is A Recession?

A recession happens when a country’s GDP contracts rapidly for two or more consecutive quarters. GDP is a measure of all goods & services produced in a country.

It’s not just poor economic growth. Recessions are often accompanied by many other characteristics – fewer available jobs, widespread job losses, and more government relief.

The United States experienced 6 recessions from 1973 to 2009. While some lasted less than a year, others prolonged an entire year or longer. Maybe the only thing that all the recessions had in common was that eventually, they ended.

How to Invest During A Recession

So, should you stay away from investing during a recession to avoid risk, or should you jump in and seek the rewards?

By investing, you may experience losses or gains. Losses will be off the table if you don’t invest, but inflation may erode the purchasing power of your savings over time, or you may miss the early stages of recovery.

If you’re in a solid financial position, your risk tolerance is high, and your time horizon is long, it may make sense to continue to invest during a recession.

However, investing during a recession calls for quite a different mindset from conventional investing.

Don’t Panic

A recession can be scary, but if you’re investing for the long term, don’t panic and run to cash in to avoid losses.

Knee-jerk reactions like selling your investments when the markets are falling might haunt you later during recovery.

Don’t worry too much about short-term market changes. Instead of panic selling, have faith in the market’s resilience and the diversification you’ve created in your long-term portfolio.

Long-term investors who put their money to work during an economic downturn have done pretty well over time.

Have an Emergency Fund

If you don’t have an emergency fund with at least 6 months’ worth of daily living expenses, you may want to focus on that before you invest during a recession.

Setting up a rainy-day fund for financial hardships, such as a home repair, a doctor visit, or job loss, should be high on your list of priorities regardless of economic conditions.

If you have an adequate emergency fund and some extra money at your disposal, feel free to invest it.

Invest Strategically

Some companies and industries are more resilient to recessions than others.

During a recession, it may make sense to avoid investing in companies or industries known to be high risk, highly leveraged, cyclical, or speculative, such as hospitality services, unproven startups, and manufacturers (and retailers) of luxury consumer goods.

A better way is to go for solid companies with established markets for their goods/services, good cash flow, and low debt.

Counter-cyclical equities perform well in economic downturns and appreciate irrespective of the economy. These may include grocery and discount stores, funeral services, defense contractors, utilities, and manufacturers of consumer staples, alcoholic beverages, and firearms.

Diversify and Spread Risk

During a recession, you should diversify your portfolio by investing in varied stocks, bonds, and funds that fit your risk tolerance and time horizon.

The goal is to balance the risk so that in the event that one of your investments dips, another one will balance things out.

That said, to be well-diversified, you don’t have to invest in everything. However, at a minimum, pick more than one company’s shares.

Go a step further and spread across global markets too. This way, you’ll not be over-exposed to downturns in any one area.

Consider Real Estate, Index Funds, and Gold

Property can be an excellent investment during a recession as the value of the asset class tends to rise when the economy recovers and consumers are more generous with cash use. Also, you may be able to secure a much better mortgage rate during a recession.

Picking funds that track stock markets such as the S&P 500 is a great way to invest at any time, but expressly so during an economic downturn. With an index fund, you’re not betting on individual companies but rather on the long-term success of a global business. Since 1926, the S&P 500 has been 10.49 percent.

Gold is an asset with a limited supply. Its value isn’t related to long-term cash flows like financial assets and is more stable. The yellow metal is regarded as a safe haven asset, and its value often appreciates when stock prices fall. More importantly, though, gold reduces portfolio volatility over the long term.

Take Comfort from History

Recessions don’t last forever.

With an investment horizon of 5+ years, you should be able to profit from the market recovery.

Conclusion

It’s natural to become overwhelmed by doomsday headlines during an economic downturn.

A recession can mean increased uncertainty and volatility in the markets. But it can also provide opportunities to well-prepared and forward-thinking investors.

Once you invest, review your investments periodically and adjust as the recession plays out and ultimately is resolved.