It’s no secret that it’s becoming harder and harder to acquire wealth. So let’s take a closer look at the ever-widening gap between the haves and the have-nots. The data is looking at America but make no mistake, this is happening all around the world!

Here are some trends to look at:

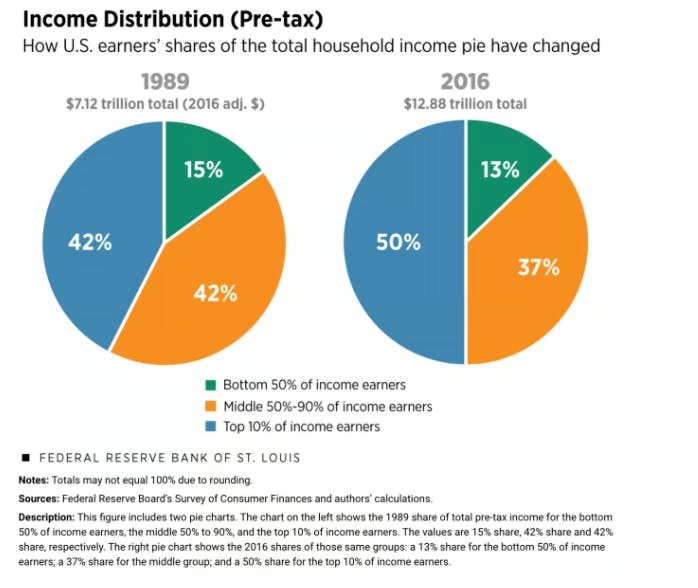

1) How Income Distribution has changed

The landscape of income distribution has changed significantly.

This change is a big deal because it means that a small group of people – the ones with the most money – are getting even richer, while everyone else is left with less.

It’s important to understand this because it affects all of us. When income is unevenly distributed, it can lead to more poverty, fewer opportunities, and a less fair society overall.

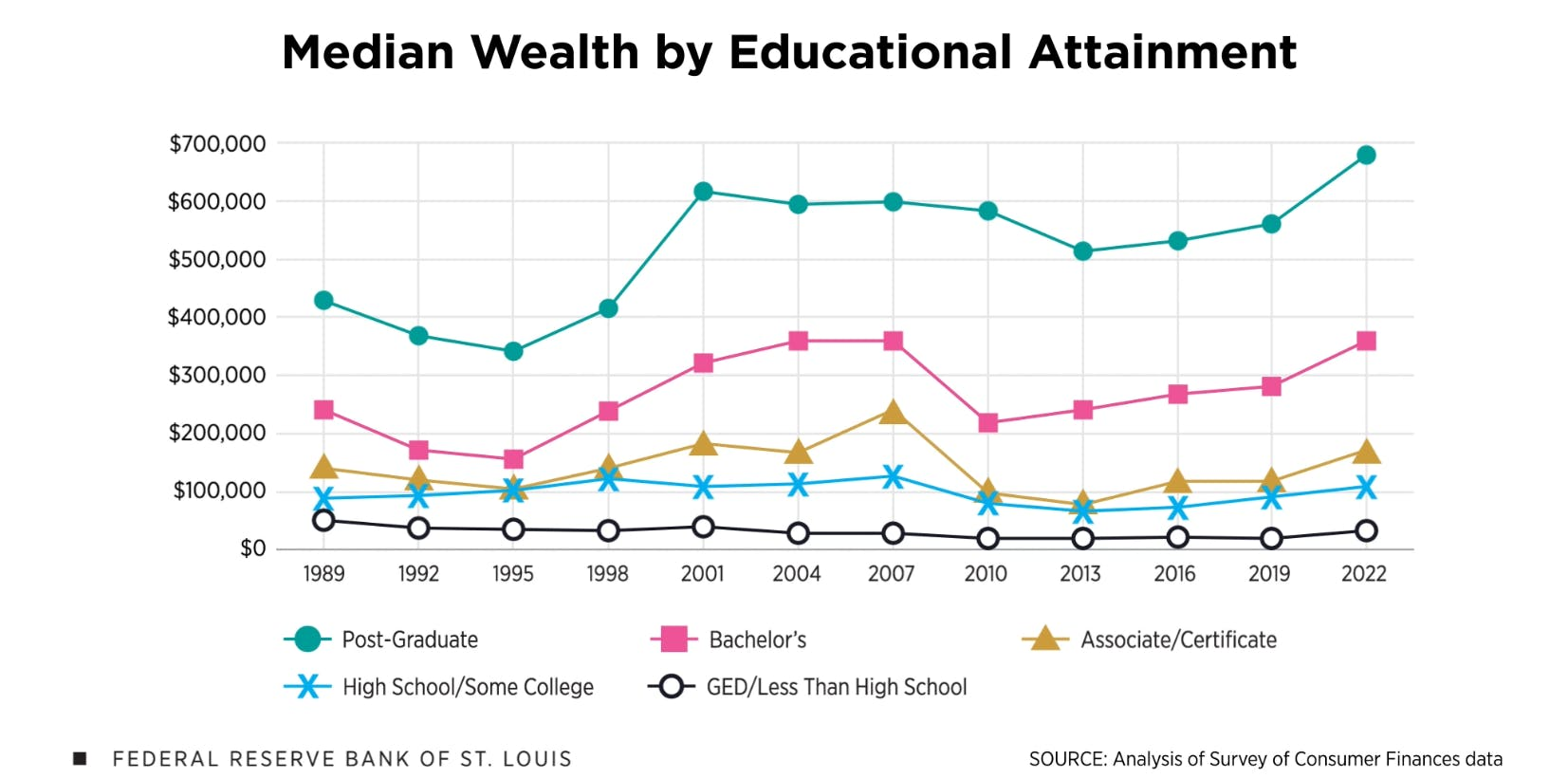

2) Higher degrees mean more wealth

Education acts as a powerful engine propelling individuals towards greater wealth. You are laying down the stepping stones towards a more affluent future.

Evidence consistently reaffirms this correlation between educational attainment and wealth accumulation. Those who invest in higher education, whether through bachelor’s, master’s, or doctoral degrees, often find themselves on a trajectory towards greater financial stability and success.

3) Middle class wealth has fallen

The middle class have seen their money pot shrink over time. While costs for things like groceries, rent, and healthcare keep going up, the money in middle-class wallets just isn’t stretching as far.

Imagine if you had a jar of coins, but every time you dipped into it, there were fewer coins inside. That’s kind of what’s been happening to middle-class wealth. Even though they work hard and try to save, it feels like they’re falling behind.

Our chart paints a clear picture of this tough reality.

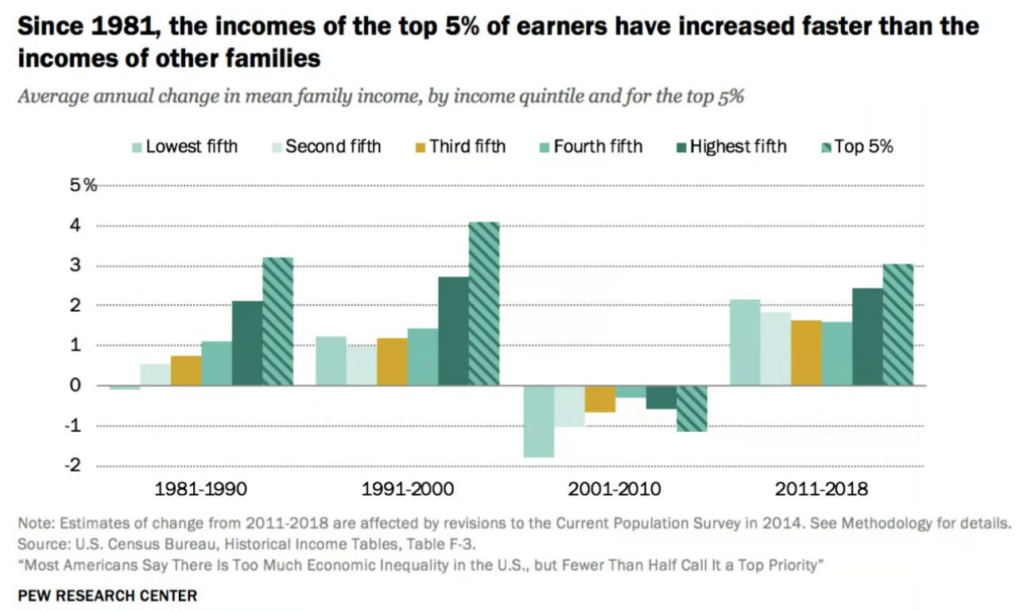

4) Income growth is faster for the wealthy

The rich just keeps getting richer. This phrase has so much more meaning today than it did decades ago. Mainly because their wealth is growing SO MUCH faster than the rest of the groups.

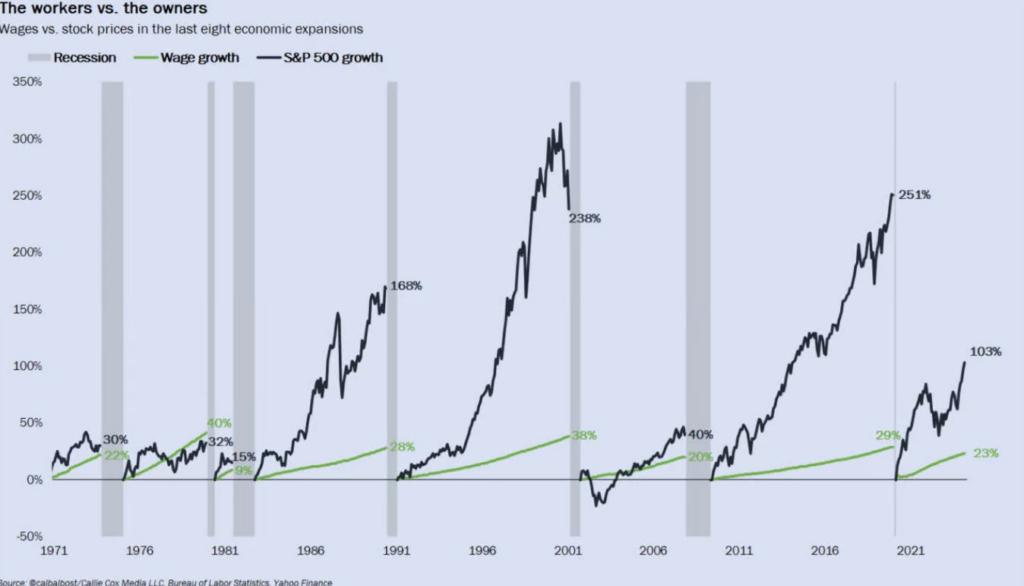

5) Stocks outpace wages

Let’s talk about a money race you might not even realize you’re in: stocks versus wages. See, for many folks who work for a living, the idea of making money from the stock market can feel like something out of a fantasy novel – distant and out of reach.

But here’s the kicker: the numbers don’t lie. When you look at the data, it’s crystal clear that stocks are zooming ahead while wages are stuck in neutral. It’s like watching a race where one runner is sprinting while the others are barely jogging.

Align your investments with your financial goals, understand the role each investment plays in your portfolio, and keep educating yourself.

With intentionality, you can avoid the mistakes I made and pave a smoother (and faster) path to financial success!

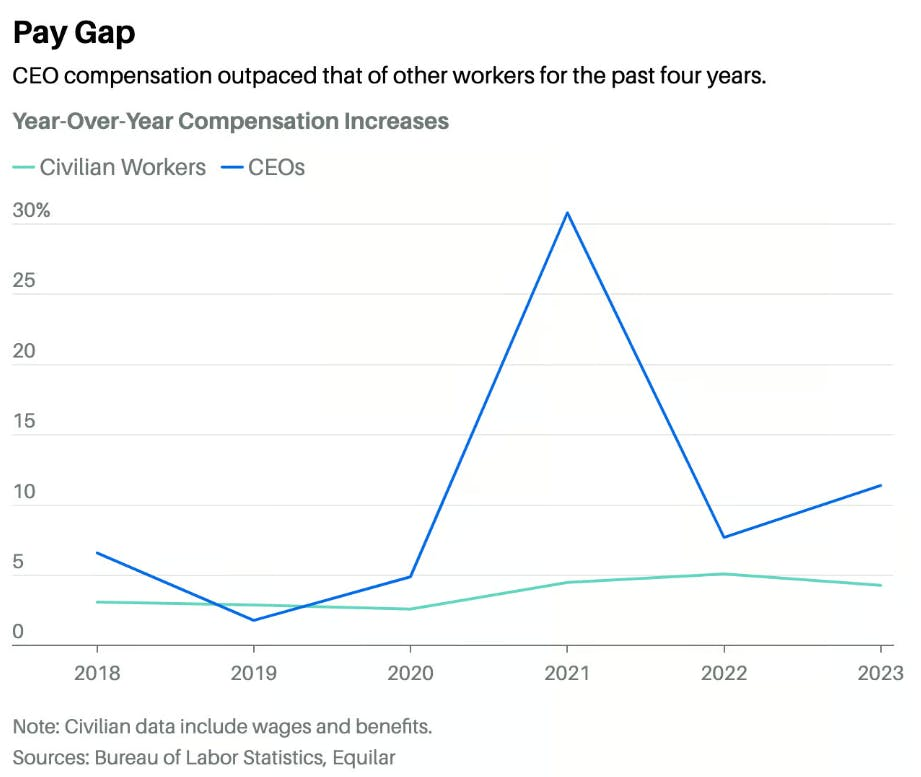

6) CEO vs employee pay

The disparity in compensation between CEOs and employees continues to widen. In the last four years alone, CEO compensation has surged by 11.4%, outpacing the modest 4.3% wage gain for workers.

Great, now what?

These charts may seem daunting and I know it’s easy to think that we’re all doomed but that’s not the case. We just have to be much more intentional about how we grow our money and get ahead.

Here’s what I’m doing:

- Investing my money to outpace inflation

- Continually investing in my education

- Building a business where my employees wages can grow alongside mine

- Help more people get ahead

What’s one thing that you are going to do?